It has a huge and active user base as well as a marketplace that makes trading of hacked credentials and stolen data seamless. The forum is meant to host several sub-communities to assist threat actors in easily connecting with each other and finding the information they need. Most of the illegal information and data shared on this forum is related to data leaks, as well as the selling of data freely.

Threat Actor’s Goals

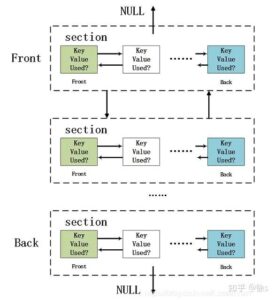

NFC is also used for identity verification, making it a target for identity theft. The app utilizes Host Card Emulation (HCE) to mimic a physical ISO NFC smart card by registering a service that extends HostApduService. This allows it to respond to APDU command sequences just like a real card would. The payloads it handles are likely customizable, enabling users to define specific NFC responses — a capability that could potentially be used to spoof identity-based card systems. Manycybercriminal activities in China are believed to be part of largerorganized crime syndicates that are state-sponsored,state-encouraged, or state-tolerated.

What We Know So Far About The Supposed ‘Mother Of All Data Breaches’

By monitoring dark web markets, we often discover data breaches before they’re publicly reported. This enables systems to detect fraud based on minute changes in transaction velocity, merchant category patterns, and even the time of day purchases are made. Financial institutions tighten their security measures to prevent fraud but that also prevents legitimate transactions as a result. One compromised payment processor or e-commerce platform can yield thousands of card numbers at once.

How Breachsense Can Help With Dark Web Monitoring

Cybercriminals frequently target online retailers and business databases to directly access large amounts of stored credit card data. Hackers exploit vulnerabilities in software, website plugins, or weak cybersecurity measures. NFC-related fraud is on the rise, as evidenced by cyber threat intelligence analysts at Resecurity. Numerous banks, FinTechs, and credit unions have reported increased NFC-related fraud and highlighted significant challenges in early detection. Chinese cybercriminals demonstrate high adaptability in exploiting NFC technologies for fraudulent purposes and create new tools to facilitate illegal operations at scale.

- Leaked credit cards from Telegram channels account for the overwhelming majority of compromised payment card details.

- I’ve worked with family-owned businesses that nearly went under after getting hit with a wave of fraudulent purchases.

- Governments and regulatory bodies will continue to tighten security requirements and compliance standards, compelling financial institutions to adopt more robust fraud prevention frameworks.

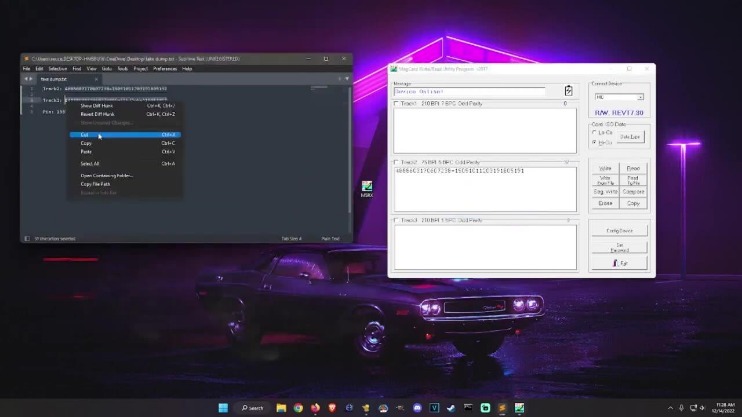

- On the same Telegram channel, they share samples of Track 2 data, exchanging experience and successful fraudulent operations.

- In the vast underground world of carding forums, where cybercriminals gather to exchange knowledge and stolen data, a beginner might feel overwhelmed by the sheer complexity and variety of illicit activities taking place.

Carding Sites 2023: Understanding The Dark World Of Cybercrime

Threads complaining about carding notwithstanding, the carding-related content on cyber criminal platforms is dwindling—even on carding-focused platforms. Experienced carders won’t benefit from sharing advice, as they used to do, and it would only increase the competition in an already-difficult market. By surfacing context around emerging threats – such as tactics used by carding groups or trending tools – Silobreaker enables fraud teams to take proactive action. This intelligence-driven approach improves incident response, limits financial loss and protects brand integrity. Fraudulent transactions may result in penalties from payment processors or legal liability under consumer protection regulations.

From NFCgate To Track2NFC – The Origin Of Contactless Fraud

Banks encourage merchants and customers to use Multi-Factor Authentication (MFA) and systems like 3D Secure (Verified by Visa, Mastercard SecureCode) for online transactions. In a more recent development, on February 19, 2025, B1ack’s Stash escalated its operations by claiming to leak an additional 4 million stolen credit card details for free. This massive data dump was publicized on underground cybercriminal forums like XSS and Exploit, serving both as a marketing tactic and a means to establish credibility within the cybercrime community. Carding is a type of financial fraud where criminals use stolen credit card information to make unauthorized purchases. It’s a popular choice among fraudsters because it’s easy to pull off and can bring in big bucks. In fact, it accounts for a huge chunk of the $914,349,424 lost to credit card fraud.

Staying Safe Online

A few days later, it was announced that six more suspects had been arrested on charges linked to selling stolen credit card information, and the same seizure notice appeared on more carding forums. In an era where technology facilitates seamless financial transactions, there exists a darker side where criminals seek to exploit the system. Carders are individuals involved in the illicit practice of carding, which entails unauthorized use of credit and debit card information for fraudulent purposes. By understanding the workings of carding, we can better protect ourselves and combat this form of cybercrime. Dark web forums are forum-styled deep, dark net websites (more or less) in the underworld part of the internet, where users mainly discuss (trade) stolen data, exploiting the anonymity offered by the dark web. The forums function as secret darknet markets (most of the time) where criminals and hackers sell stolen goods.

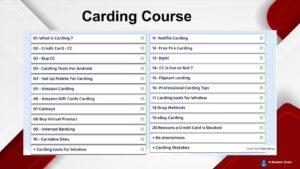

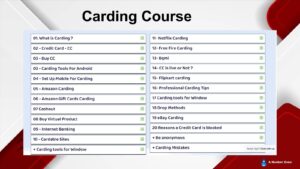

In this section, we will delve into the world of carding tools and techniques, examining their functionalities, benefits, and drawbacks from different perspectives. The lucrative world of carding is driven by the underground economy, where cybercriminals engage in various illegal activities to profit from stolen credit card information. This thriving industry has its own set of profits and losses, which shape the dynamics of the carding forums and credit muling networks.

And, once obtained via malware, phishing, or card-skimming attacks, the data may be sold or shared with other crooks on so-called carding forums. The BidenCash stolen credit card marketplace is giving away 1.9 million credit cards for free via its store to promote itself among cybercriminals. Carding shops, or the vendors selling on these platforms, often get their material from “sniffers” and “skimmers.” A sniffer is a malicious script a threat actor injects onto retailers’ websites. The script steals customers’ personal and payment details, including credit-card data.

Immediate Steps If Your Card Data Is Stolen

They’re a marketplace for selling and buying stolen data that includes personal identities, credit card information, and login credentials to various social media accounts and even bank accounts. Financial institutions can proactively strengthen their defences by integrating intelligence derived from FraudAction. This involves leveraging insights from compromised credit card feeds into security protocols, enabling institutions to identify potential threats, block fraudulent transactions, and enhance overall risk management.

Elliptic Analysis: Russia Seizes Four Major Dark Web Carding Sites With $263 Million In Crypto Sales

Carding refers to the illegal practice of using stolen credit card information to make unauthorized purchases or withdrawals. It is a form of financial fraud typically involving stolen credit or debit card numbers, expiration dates, cardholder names, billing addresses, and card verification values (CVVs). Criminals engaged in carding acquire this sensitive data through various methods, including phishing attacks, malware, skimming devices at ATMs, and hacking into databases of retailers or financial institutions. The allure of easy money often leads individuals down a treacherous path, and credit muling is no exception.

Protecting Personal Information

A skimmer usually refers to a small, physical device that allows criminals to obtain information from a card’s magnetic stripe when it’s inserted into or swiped on a payment machine. Silobreaker helps organizations stay ahead by continuously monitoring dark web forums, paste sites, marketplaces and breach databases for early indicators of card fraud. Its intelligence-driven platform enables early detection and prevention, helping organizations mitigate risks, protect sensitive data and intellectual property, and maintain brand trust and customer loyalty. Sources include phishing scams, infostealer malware, compromised point-of-sale systems or breached databases.